I want to be a loan

Taking out a car loan can be a scary prospect. In particular, all that talk about interest rates is confusing. How much do I really pay and where/when? Having a feel for how much you will really pay off each month is an important part of understanding what you are getting into.

Write a Python function that conform to the following:

- Function name

- loanTable()

- Parameters

- The amount of money borrowed

- The annual interest rate [The monthly interest rate is 1/12 of this value].

- The amount paid towards the loan each month

- The number of months we will be paying off the loan

- Return value

- Nothing.

- This is what is known as a "non-fruitful" function. It doesn't produce results in the traditional sense. Instead it prints inside of the function.

- So what does it print:

- The function should print one line of information for each month requested by the parameter. That line should include, IN THIS ORDER

- Month #

- Interest accrued during the month

- Value of the loan at the end of the month (which is balance + interest - amount paid)

- The function should print one line of information for each month requested by the parameter. That line should include, IN THIS ORDER

- Examples

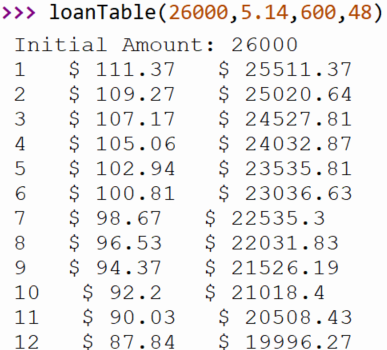

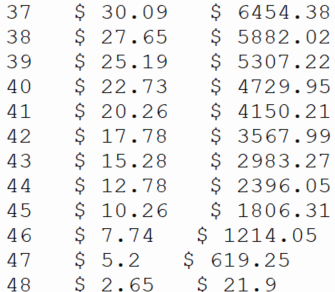

- The following is an exampe of me taking out a 26,000 loan from my bank at 5.14% interest (what Veridian CU was charging when I wrote this a while ago) and paying $600 a month for 4 years (48 months).

. . .

- Notice that after all this time, and paying 48*$600 or $28,800 on the loan, I still owe another $21.90

- Special Notes

- Round the prices to 2 decimals (Remember, that this won't add decimal places. Just remove them)

- Include $ symbols as shown.